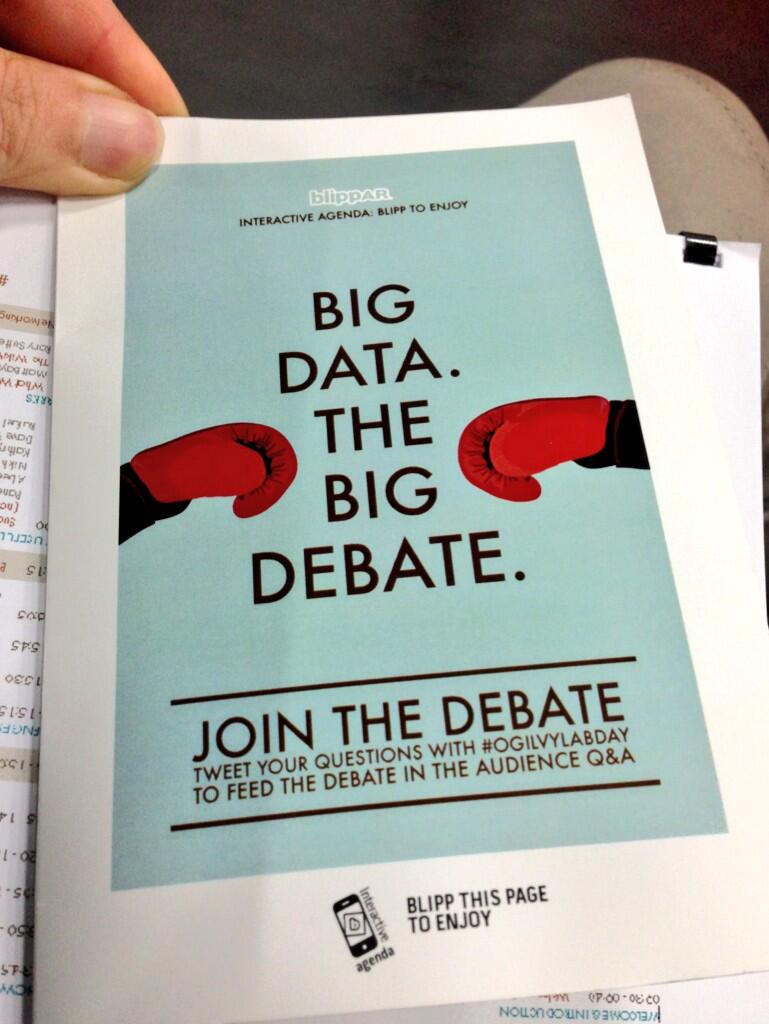

One of our startups, Seeker, were invited to an Ogilvy Lab Day yesterday, where the entire event was focused on Big Data. Tielman de Villiers, the co-founder and CTO at Seeker Industries, went along to find out just how big the debate is around big data. He was particularly keen to hear opinions surrounding just who owns all of this data, is it possible data can become too “clever” for its own good, and is there really that much value in “big” data?

Here is his report, for those of us who missed the event.

"There are currently many unanswered questions concerning the creation of big data, it's ownership, and it's accuracy. Let's go through some of the issues discussed at the Lab Day.

Matt Bayfield, head of data practice at OgilvyOne Worldwide, asked what is the role of advertising, if brands start knowing everything there is to know about you? It’s not only the ownership of the underlying data, but also of the data on top the data, as Dr Trevor Davis, consumer products expert at IBM, mentioned. For example, if you start making predictions using Facebook’s Opengraph or Google Trends, where does the legal responsibility start and end?

And what if all that personal data is actually a bit of a lie? So, even if Google, Facebook and Amazon captures, processes, segments, and targets everything users are willing to share, how “truthful” and representative is it really? Liri Andersson, co-founder of This Fluid World, spoke of examples where the “real” data is still outside of the “system”. For example, product recommendations often occur in forum-based discussions, which influence our decisions about purchases. In other words, how useful is the big data really with regards to predicting future behaviour?

Then there’s the slightly “scary” part of big data, when data analysis algorithms become so complex and relied upon by corporations that plain old human common sense goes out the back door. Stan Stalnaker, founder director of Hub Culture and the brains behind the Ven currency, warned of becoming too reliant on machine driven algorithms. Just look at what is happening in the world of corporate finance with programs driving and controlling sales in financial markets. What happens when this happens in the world of digital marketing, with the most personal of our personal data?

Big data also seems to be big grey voids. Spotting the little clusters of data with significance inside the masses of greyness (ie, “sparse” data), and doing it in “slow time” (ie, looking back at long historical trends, as opposed to right here, right now) is something which Dr Davis used to “predict” fashion trends. For those left wandering, it’s steampunk."